Table of Contents

Navigating Financial Waters Amidst Political Turmoil

Thirteen months might seem a comfortable distance for the financial markets to preemptively navigate potential fluctuations. However, the forthcoming U.S. Presidential election in 2024 casts a complex shadow, with uncertainties that are becoming progressively intricate and demanding to ignore.

Congressional Discord and Financial Implications

With a divided Congress recurrently entwined in disputes over government funding, the U.S. bond markets are simultaneously grappling with the priciest Treasury borrowing witnessed in the last 16 years. The underlying fluctuations in long-term trajectories for interest rates and fiscal policy are adding an additional layer of complexity to an already volatile situation. A precarious miss during a debt ceiling confrontation in Spring cascaded to the diminution of another Triple-A sovereign credit rating.

Moreover, a further entanglement over the succeeding year’s spending bills has teetered on the brink of governmental shutdown, with a temporary resolution merely postponing the issue to November 17. Moody’s recent caution hints at a disruption in public financing and a prospective jeopardy to the last standing AAA credit rating from the principal three agencies, attributed to dysfunction and potential interruptions in debt servicing.

A Polarized Political Landscape

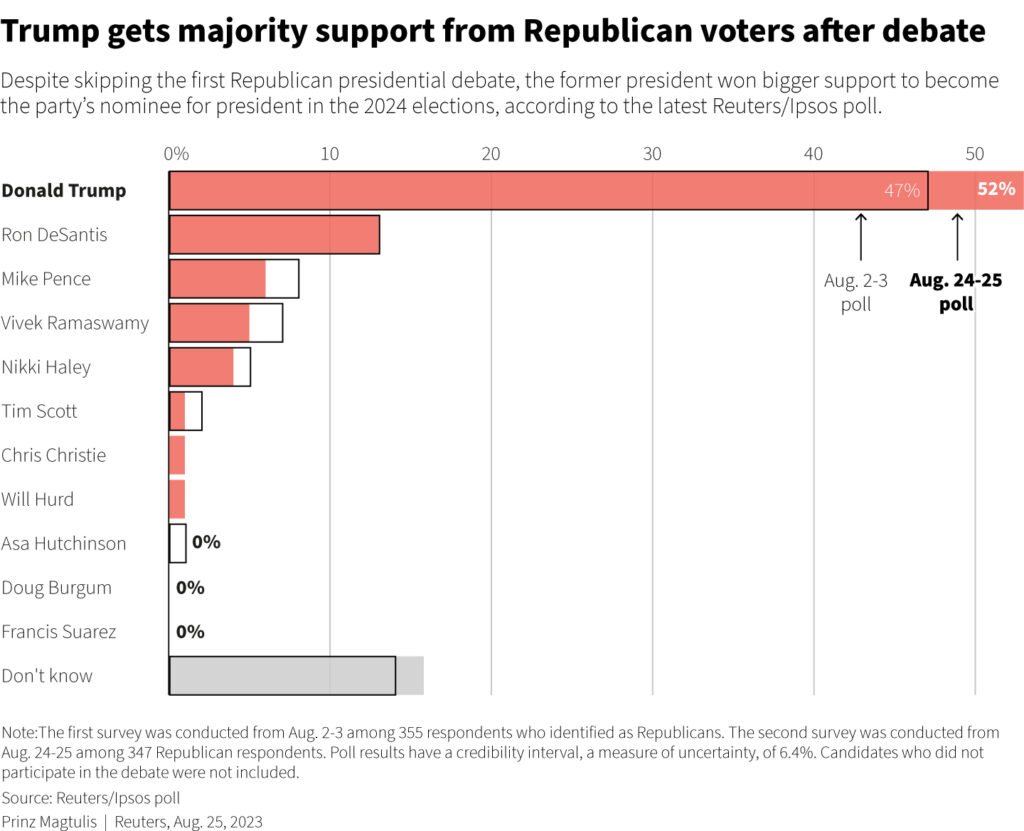

While some may attribute the fiscal and political melee to the cut and thrust inherent in a polarized political arena, the looming prospect of fiscal tranquility in the upcoming years is already under scrutiny. Former Republican President Donald Trump and incumbent Democrat Joe Biden are neck and neck in the preliminary polls, offering a hypothetical preview of the 2024 White House race. Despite Trump being enmeshed in several legal battles pertaining to his business dealings and attempts to undermine the 2020 election results, some foreign betting markets lean towards him as a narrow favorite for victory.

Anticipating Policy and Political Shifts

The tangible possibility of Trump’s return presents a conundrum, particularly in international spheres where projections about subsequent policy and global relations shift become an intricate puzzle. Trumpian factions within Congress have strategically utilized swing votes to prompt funding hiatuses throughout the year, championing stringent spending cuts, migration restrictions, and the severing of established international alliances, such as the funding cut for Ukraine.

Furthermore, another global relations reset, particularly amidst escalated geopolitical tension, appears to be a daunting prospect for numerous international analysts. Not to mention the potential about-turn on climate policies and the myriad of unresolved queries surrounding the democratic process itself. Erik Nielsen, Unicredit’s Chief Economic Advisor, posits, “A Trump victory in 2024 would be nothing less than catastrophic for the U.S. and for the world.”

An Uncertain Economic and Political Future

Undoubtedly, the extremities of political and policy options are both broad and divisive, complicating the task of deciphering potential U.S. economic and political policies in the next 13 months or even five years.

Conclusion: Girding for Gridlock

Financial markets, typically reticent to price hypotheticals far removed from a major risk event, are further complicated by the disarray stemming from both economic growth and market performance during the respective terms of the two politicians, skewed by the pandemic’s interference.

A salient observation from hedge fund manager Stephen Jen is that the acute domestic disagreement between the two sides centers on issues of equality and realms encapsulated by environment, social, and governance matters. The financial markets may invariably pivot towards a resumption of Trump’s “America first” economic agenda, prioritizing tax cuts and uplifting U.S. asset prices.

However, even a spending cut offset might not directly address the blazing rise in long-term borrowing rates, propelled by growing assumptions of a ‘high pressure’ economy persisting alongside escalating primary budget gaps and debt piles. Moreover, any policy speculation heavily depends on the composition of Congress – which, judging by the current national divide and the likely continuation of split allegiances, seems destined to endure its existing dysfunctional status quo.

Goldman Sachs recently highlighted the spike in Treasury borrowing costs and the congressional discord, igniting fresh debates about U.S. debt sustainability, and thereby increasing its assumption of interest expense on government debt to 3% of national output by 2024 and 4% by 2030, superseding the early 1990s peak by 2025.

Navigating through these intricate economic and political waters will undoubtedly pose a multifaceted challenge for investors, policy makers, and global stakeholders alike, especially with the 2024 election appearing to offer no respite from the ongoing fiscal war.